how are property taxes calculated in fl

The more valuable the land the higher the property taxes. The millage rate for Boca Raton is 18307 per 1000 of value so you are paying 1831 for every 1000 in taxable.

Millage Rates Walton County Property Appraiser

A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home valueA number of different authorities including counties municipalities school boards and special districts can levy these taxes. Property taxes in Florida are implemented in millage rates. Find the assessed value of the property being taxed.

For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of. Taxable Value X Millage Rate Total Tax Liability. The median property tax on a 18240000 house is 176928 in Florida.

Just Value Assessment Limits Assessed Value. Then all there is left to do is to pay Florida property tax. When it comes to real estate property taxes are almost always based on the value of the land.

But because real estate values have. Setting tax levies appraising property worth and then receiving the tax. Florida Property Tax Rates Property taxes in Florida are implemented in millage rates.

This keeps the assessed value from going up more than 3 a year for a primary residence. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to. There are also special tax districts such as schools and water management districts that have a separate.

Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. The simple formula is Taxable Value x Millage Rate rate per 1000 of value. West Palm Beachs operating property tax rate for Fiscal Year 2021 will remain unchanged at about 835 per 1000 of taxable value.

To determine your tax liability use the Florida property tax calculator below. Florida real property tax rates are implemented in millage rates which is 110 of a percent. The median property tax in Florida is 097 of a propertys assesed fair market value as property tax per year.

Most often the taxes are collected under one assessment from the county. See Results in Minutes. Just Value - Assessment Limits Assessed Value.

If values are rising faster than 3. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. To calculate the property tax use the following steps.

Taxable Value Millage Rate Total Tax Liability. Florida property owners have to pay property taxes each year based on the value of their property. It is crucial for land owners to critically review this Notice and determine whether the assessment is fair and accurate as the mailing of the notice commences a very short window.

Receipts are then dispensed to related entities per an allocation agreement. Overall there are three stages to real estate taxation. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property tax assessor. More complicated is the assessed value due to Floridas Save Our Homes cap. Each county sets its own tax rate.

Assessed Value - Exemptions Taxable Value. The average property tax rate in Florida is 083. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. A local millage rate a dollar amount per 1000 of taxable value is applied to calculate the annual tax. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys taxable value.

Tax amount varies by county. One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. Average Property Tax in Florida Per County.

This simple equation illustrates how to calculate your property taxes. Assessed Value Exemptions Taxable Value. Answer 1 of 3.

Property taxes apply to both homes and businesses. Real Estate Property Tax Constitutional Tax Collector 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. About 835 per 1000.

The median property tax on a 18240000 house is 191520 in the United States. How much is property tax in West Palm Beach. Every August Florida Property Appraisers will send out their TRIM notices or Notice of Proposed Property Taxes advising all tax payers of the proposed assessment on their properties.

This equates to 1 in taxes for every 1000 in home value. Enter Any Address Receive a Comprehensive Property Report. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is determined by local taxing authorities.

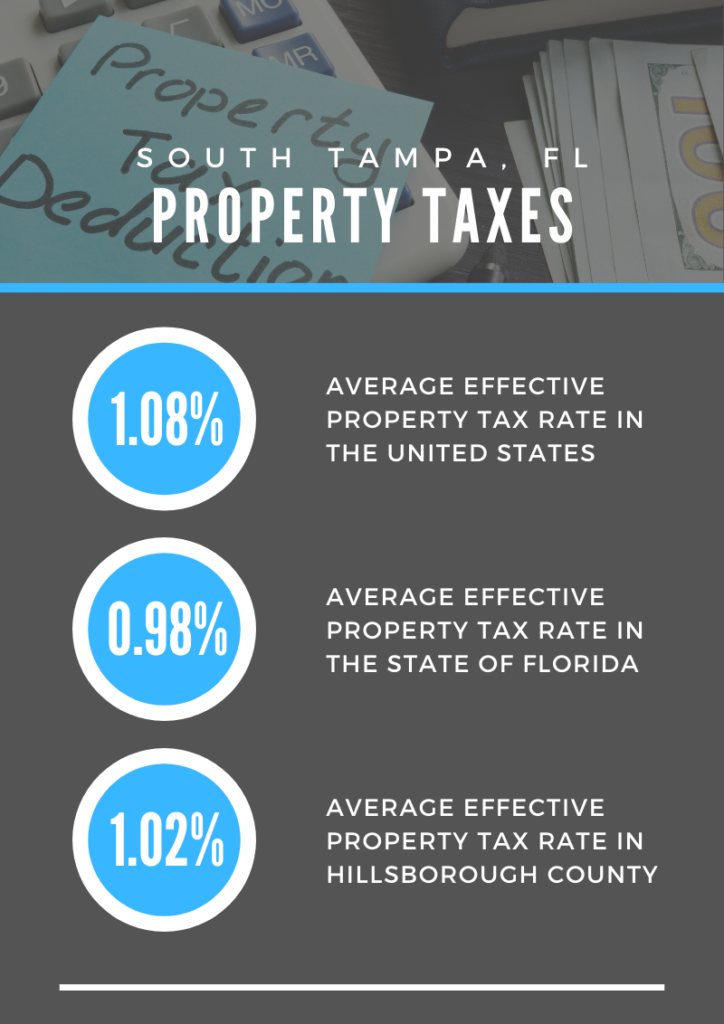

Ad Property Taxes Info. Floridas average real property tax rate is 098 which is slightly lower than the US.

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage Interest Mortgage Interest Property Tax Tax Deductions

Florida Homestead Exemption How It Works Kin Insurance

Real Estate Taxes City Of Palm Coast Florida

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Refinance Calculator Refinance Mortgage Refinance Calculator

See How Low Property Taxes In Florida Are Stacker

Florida Property Taxes Explained

Property Taxes In South Tampa Fl Your South Tampa Home

Industrial Leasing 101 Infographic Industrial Leasing Florida Infographic Building Insurance Industrial Real Estate

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Cape Coral

The Best And Worst U S Cities To Retire Retirement Retirement Advice Retirement Finances

Florida Property Taxes Explained

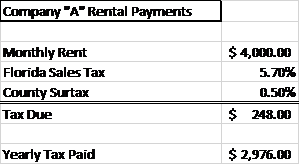

How To Calculate Fl Sales Tax On Rent

Florida Property Taxes Explained